A disciplined approach personal finance and wealth creation.

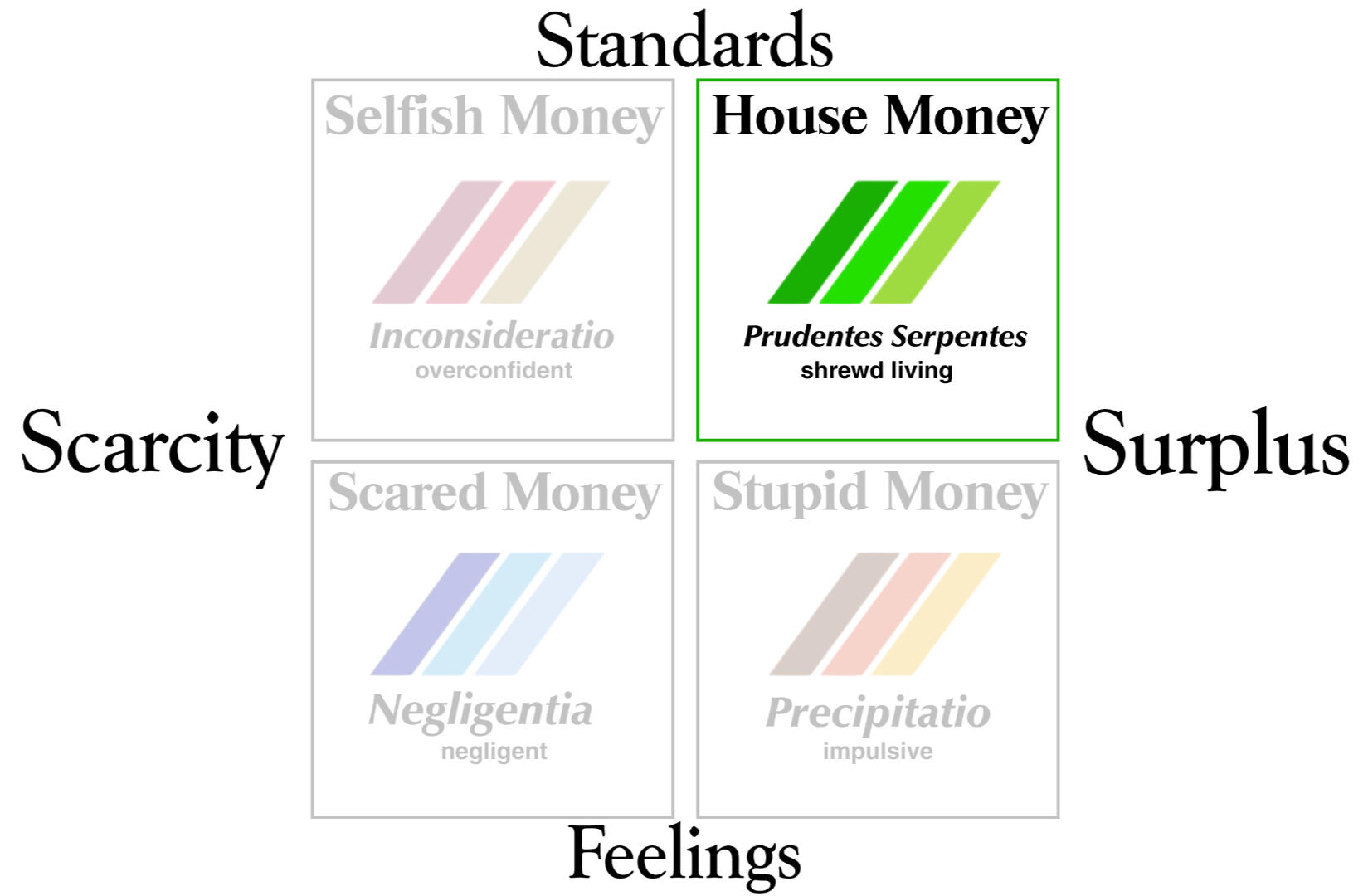

The Four Moneys™ Active Investing Thesis

"Where is the wisdom we have lost in knowledge?" - T.S. Eliot

We are living in the most advanced, connected, and efficient age in human history.Yet, we are more anxious, irritable, and directionless than ever. Despite more knowledge, inspirational content, technology, and data available, we’re seeing record levels of debt, scams, addiction, mental health decline, and the inability to navigate life transitions.How can this be?

The majority of financial education, and education in general, programs, apps, and gamification do not deal with:

1) underlying beliefs, FUD, and culture;

2) nor develop the virtues, which actually build wealth: (tangible & intangible) assets.

The current landscape of well-intentioned financial literacy programs, orgs, and apps are built to deliver information at scale. They signal social responsibility, and are easy to build, but are transactional in nature, not transformational.

Therefore, a comprehensive framework understands that a culture starts with lived experiences, which creates expectations and beliefs. Expectations and beliefs drive our behavior. Behavior forms habits. Habits reinforce the culture. The culture cycle can change with honesty, and deploying virtue.

1. The Culture

“We've all been raised on television to believe...we'd all be millionaires, and movie gods, and rock stars. But we won't. And we're slowly learning that fact. And we're very, very pissed off.” ― Chuck Palahniuk

The word on the street is the traditional American Dream is toast. As a result, three micro-cultures have developed in an attempt to compensate, and respond to this fact. They are: "not with that attitude" or, hustle culture, "it's toxic anyways" or, soft living, and "the whole thing is fake" or, financial nihilism. There are fringe "burn down the system" movements, but these three are most common. There is also a proposed fourth, to be introduced later. These 3 cultures are fluid and can change for someone based on individual circumstances.

Three Micro Cultures

HUSTLE CULTURE - The basic plot is the only way to win is to outwork everybody by any means necessary to win. Some employ ethical means, others subscribe to: lie, cheat, steal, if you have to...whatever it takes! The game of life is often seen as zero-sum, or essentially "king of the hill." Therefore, grind, focus, optimize, and mindset your way to success. If you fail, you didn't go hard enough.

SOFT LIVING - Can be a response to hustle culture, but also a coping strategy to an "unfair" and "toxic" competitive and performance-based culture. It emphasizes balance, and self-care (good), but to an extreme where avoidance and complaints are virtuous. Places demands on the workplace, school, or politics to accommodate fairness, balance, happiness, and success.

FINANCIAL NIHILISM - Stems from a perceived injustice of a rigged financial system. Lack of fairness means markets and money have no inherent value. Therefore, to participate in speculative and absurd investments, or even gambling gives a sense of some meaning via pleasure, agency, and belief in "better odds" than a rigged and meaningless system.

2. The High IRR of Prudence

IRR (internal rate of return) is the rate of gains you expect from an investment you make. It calculates the value of what you get out of it, equal to what you put in (once time and perceived value are factored). In other words: is the return on my effort worth it, once my time and value are truly considered?

Knowing your micro-culture is the first step to personal asset management (time, skills, money, relationships, etc.). The second is a rebalancing of values. In the age of technology and AI, efficiency and speed are prioritized values. However, efficiency demands an opportunity cost decision from you. Most choose to jettison the most inconvenient, but effective thing in our arsenal: Prudence.Prudence means to fully understanding what it is that you are seeking, and how to avoid destruction. It is applied patience--a virtue, that takes indeterminate time and effort to build, but has a direct link to our well-being.1 In fact, our lack of prudence is what weakens us financially, relationally, and mentally; the absence of self-control.

"We castrate and bid the geldings be fruitful." - C.S. Lewis

Therefore, we are not struggling from lack of good content creation, gamified apps, self-help, technology, or knowledge either in the form of financial literacy programs or awareness campaigns. The reason we are struggling and failing is because we stopped training and building prudence. There is an expectation of good habits, financial or otherwise, but we removed the means to establish them. Believing they are too slow, and inconvenient. While having a personal finance AI agent can be very useful, without virtue, we will become dependent, relinquishing our growth, potential stories, and well-being.

Forward Deployed Asset Management

What good is investing if you are paying more in debt elsewhere?

Four Moneys is applied prudence in the age of AI. It is useful for areas where we use our intangible assets to gain tangible ones:

personal finance

mental health

athletic performance

professional settings

Four Moneys provides a diagnostic tool for self-awareness, and for avoiding the tactics undermining our prudence in the first place.It is also a decision-making compass to move to a forward deployed investment strategy, or house money: being proactive and shrewd investors of time, money, resource, tech, attention, and friendships.

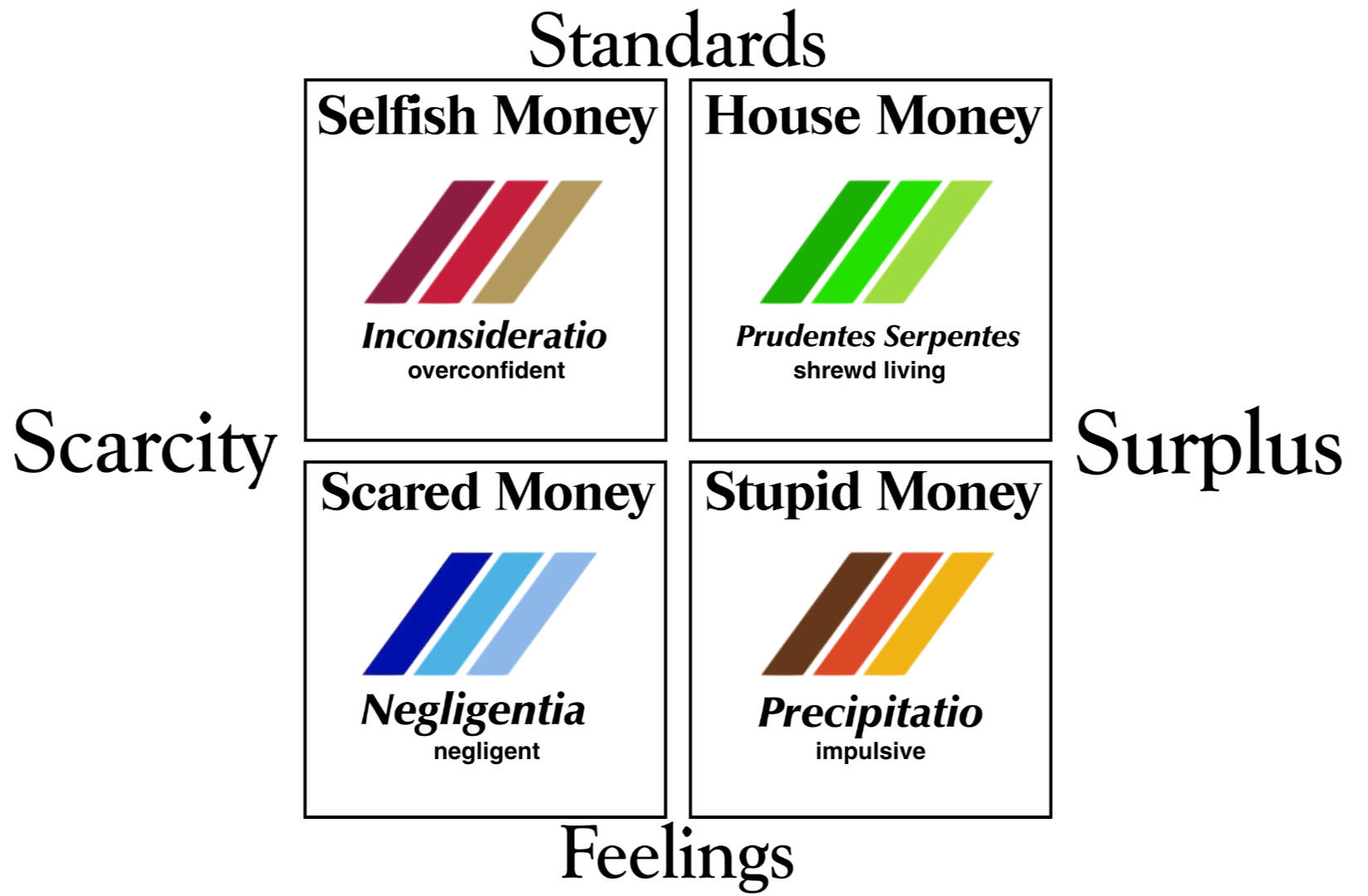

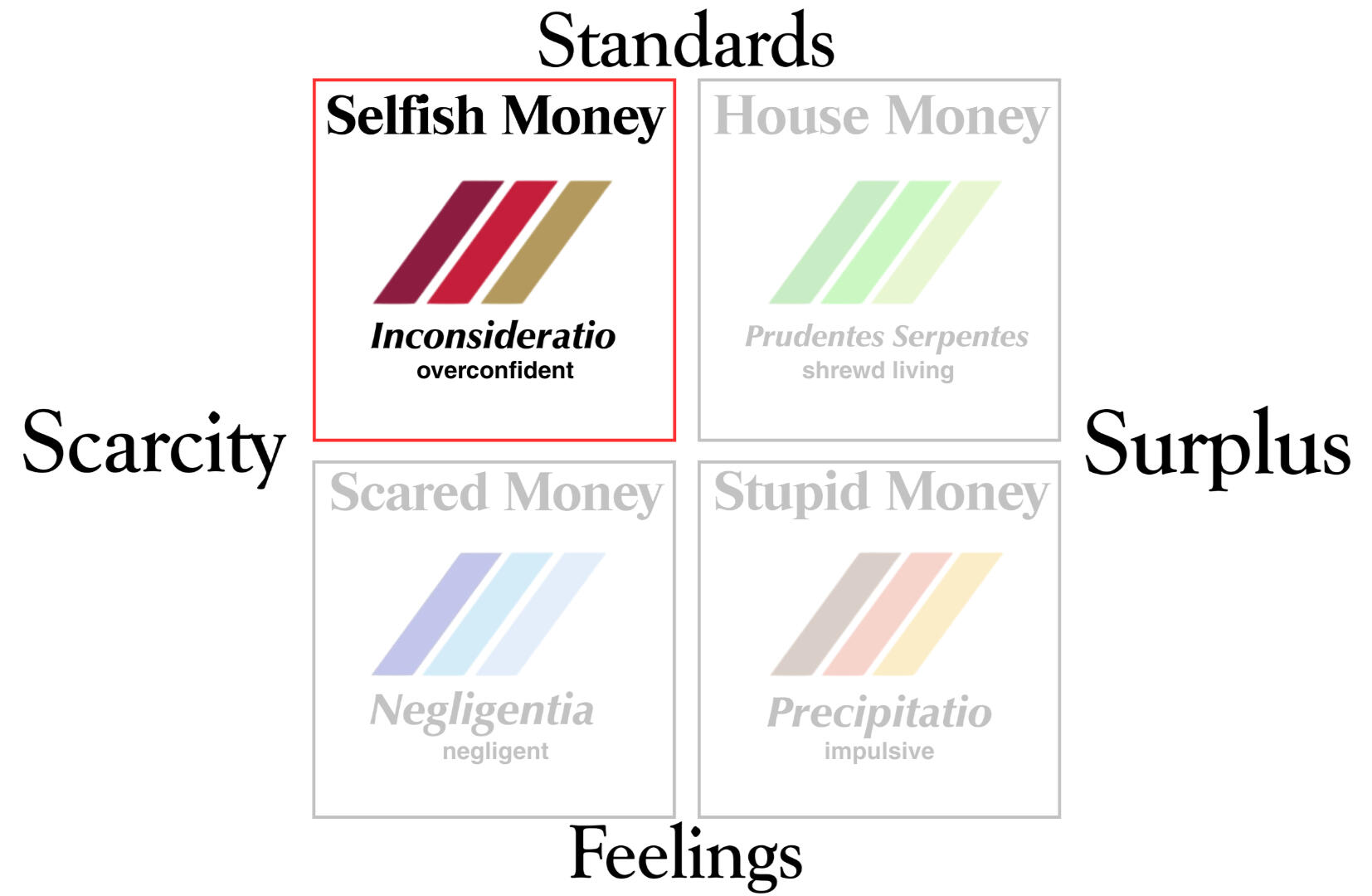

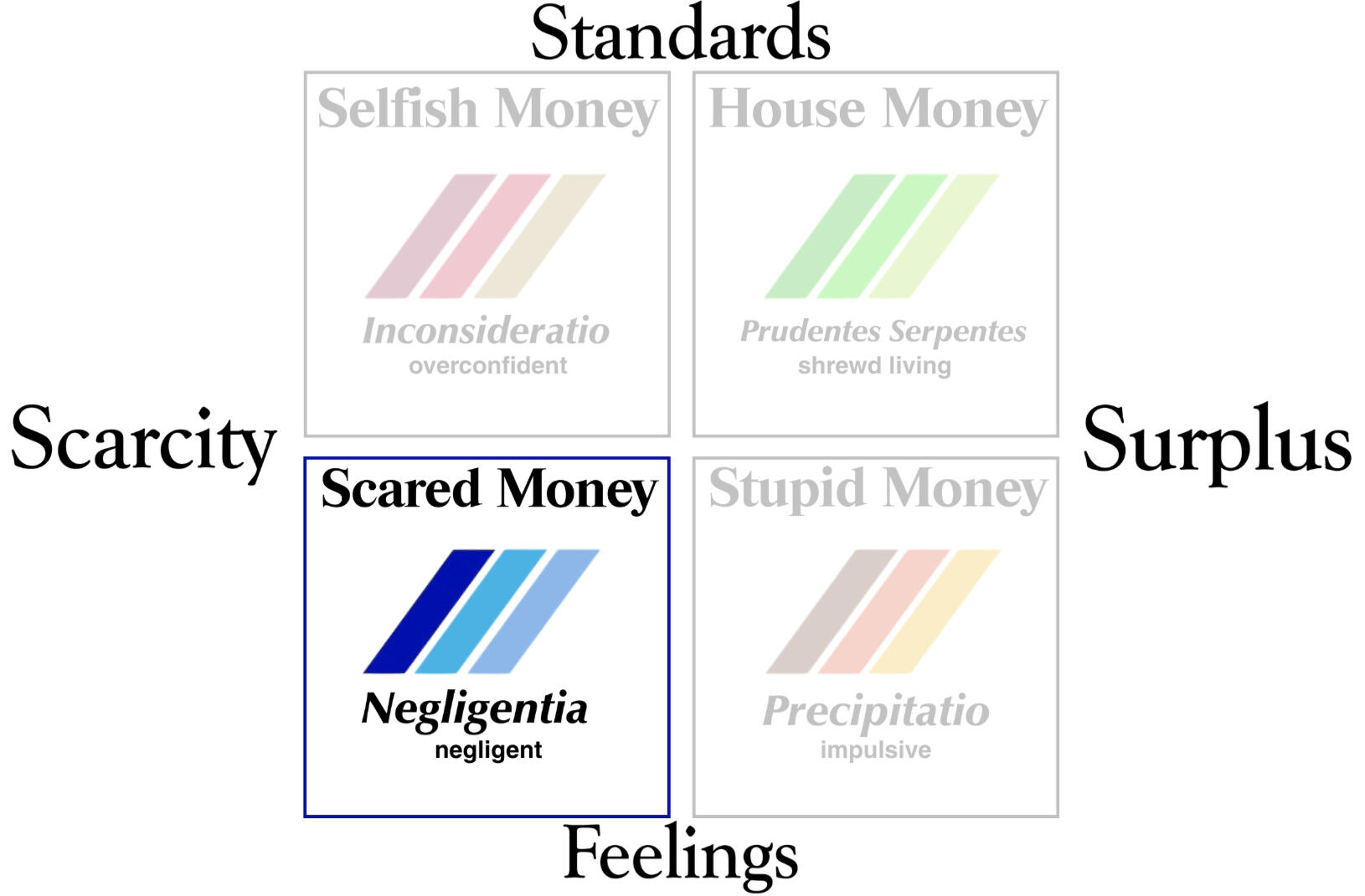

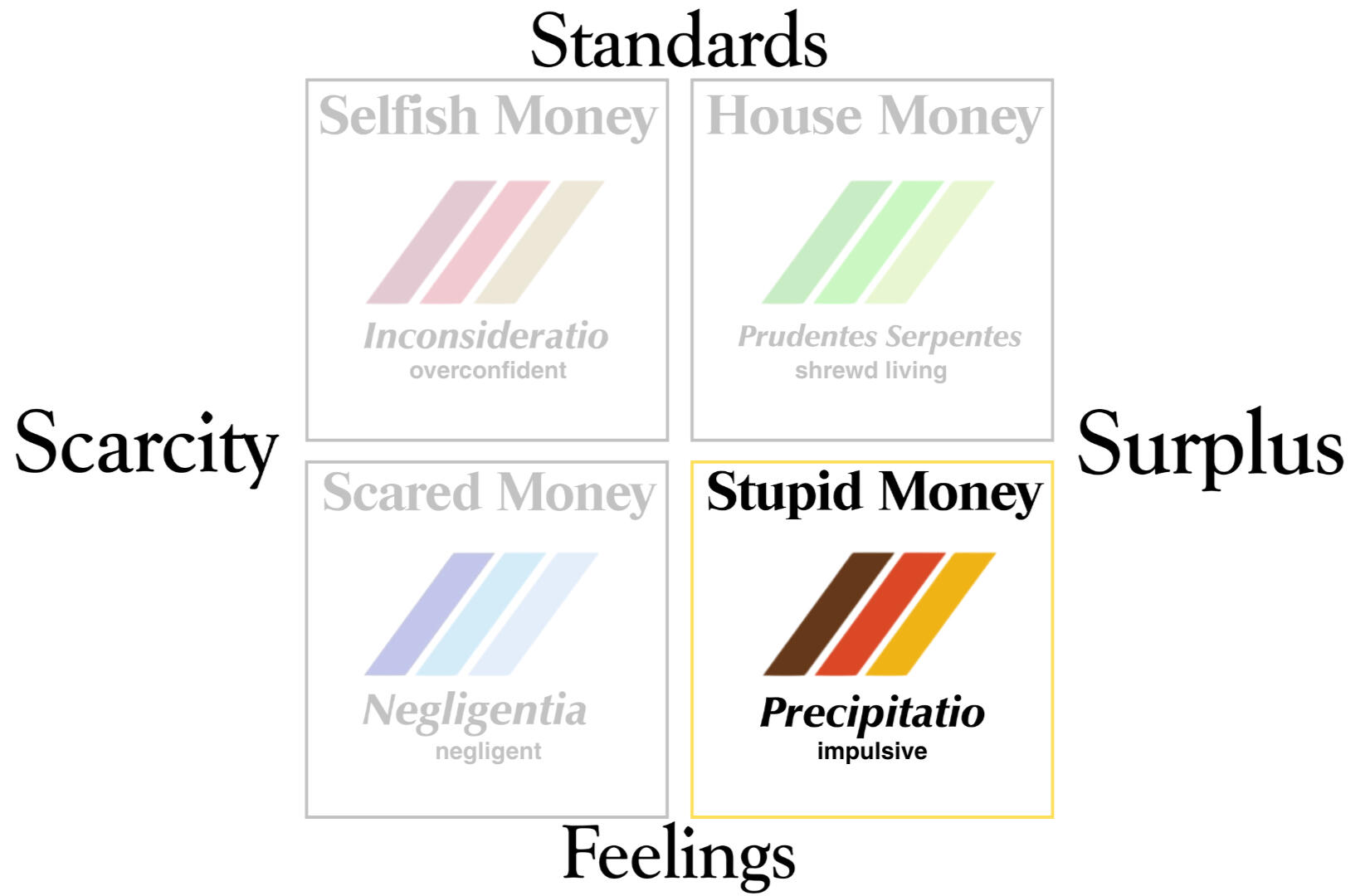

Four Moneys Active Investing Framework™

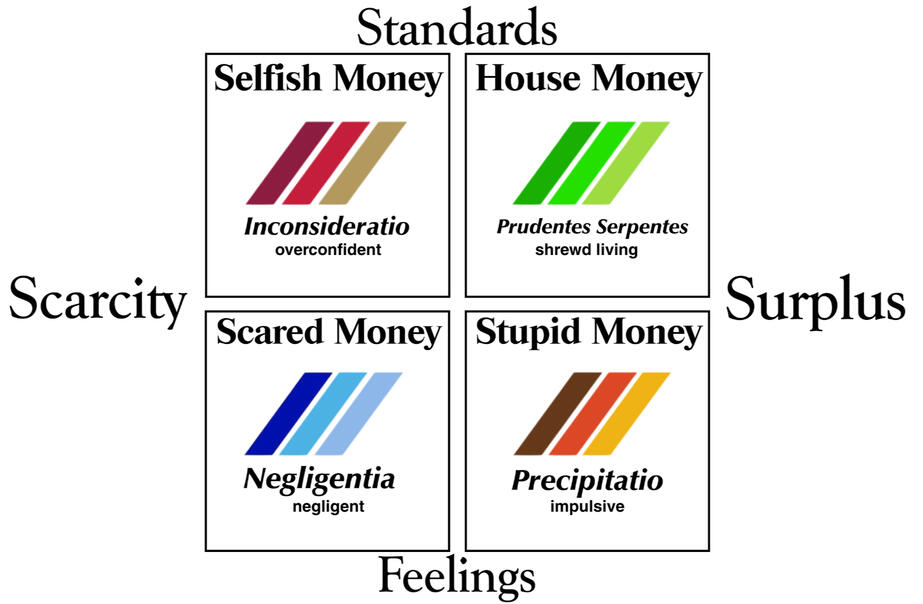

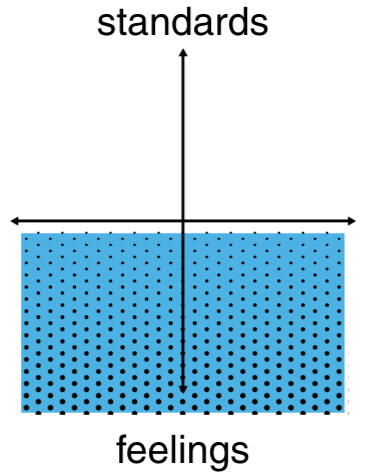

The assessment tool is structured primarily around how we see the world, and what we hear (or listen to). The labels and quadrants are fluid, not fixed. The fancy Latin subtitles underneath are classic philosophical categories to distinguish the specific ways in which we become impatient, or imprudent in decision-making

No one readily admits to scared, selfish, stupid money thinking, or decisions. We are convinced it is "Smart Money," otherwise we wouldn't do it. These labels are intentional to see decisions for what they are. This does not mean being competitive, or finding moments for self-care are bad. It is to help give proper weight & wisdom to our decisions.

Once you determine where you are, you will notice the micro-culture parallel. This gives you a compass to make a move to, ideally, a state of living House Money. In other words, you need to be prepared to be proactive in moving quadrants. Change won't happen on its own.

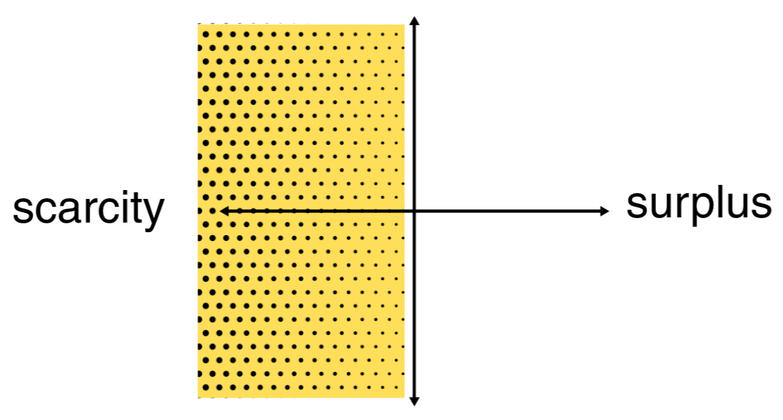

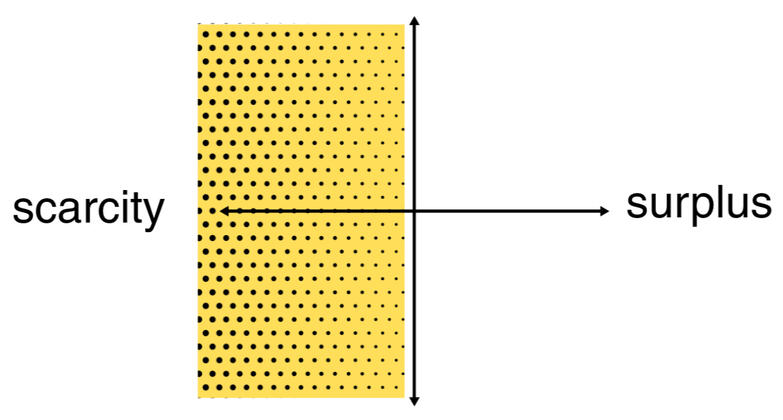

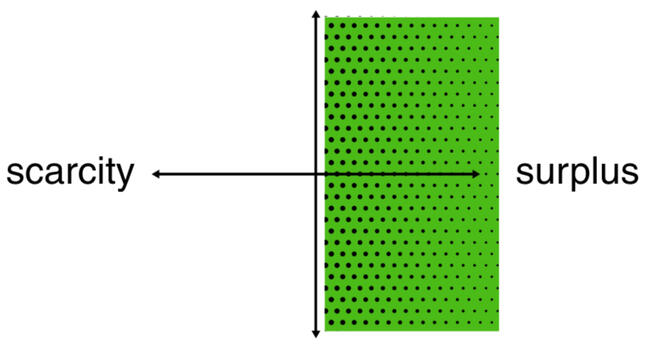

X- Axis: How the World is Seen 👓

There are two perspectives or worldviews on how you see, or imagine the world: scarcity or surplus. The left quadrants represent seeing the world or a situation with scarcity (not enough), or life as zero-sum. Since there are finite opportunities, or wealth it is your duty to grab your share, or get whatever you can.

The right quadrants believes and sees that there is enough resource to create new forms of wealth, or opportunity. This might be now, or later. Even after a loss, or with limited material, it will work itself out through problem solving, or fortune.

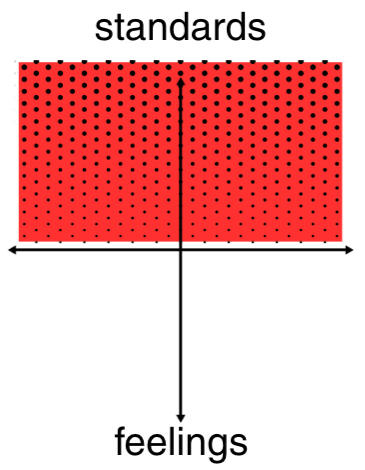

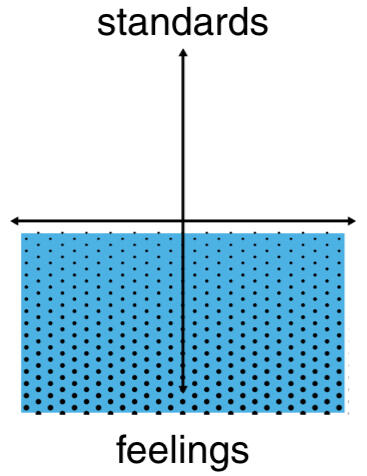

Y- Axis: What We Listen To 🎧

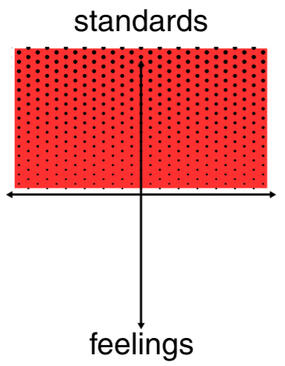

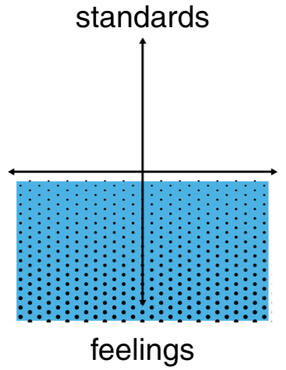

The second dynamic is what we hear or reason before we make a choice. Above the line is leading by listening to a set standard/rule, or an ambition we have, or goal we have set. Being above the line, does not mean you don't account for emotions or feelings, or that they aren't valuable. It simply means they are subservient to standards.

Below the line is leading by listening to our thoughts or emotions. It doesn't mean you don't have values or standards, just that emotions, past comments, intrusive thoughts, desires, and feelings have a tendency to rule over them, and ultimately make the final call in a decision.

Once you figure out which quadrant you fit into, based on how you see the world, and what guidance you listen to; each one comes with its own set of "cultural" traits...

⏱️ Relationship to Time

Considering there is a time value of money, imprudence is a consequence of myopia (we become shortsighted) when we over, or under estimate the past, present, or future when making a decision.

🏎️ Drivers

Internally, there are always desires driving our choices to be imprudent. It is critical to know what the motivating force is in order to avoid manipulation through self-sabotage, or by others.

🐴 Persuasion

We are constantly being persuaded by someone to pull in "Trojan Horses" or "drink the Kool-aid'. The reason is they stand to gain from our time, money, attention, or destruction when we do. Familiarize yourselves with their sales tactics.

🏃 Behavior

This is a general snapshot of how we look, and live out the very actions we have justified in our mind. We may call it "scared" or "stupid" or "selfish" money, but this is what it entails.

🤺 Defense

Thomas Aquinas did a lot of thinking, and argued there are 8 parts of Prudence: Memory, Understanding, Docility, Shrewdness, Reason, Foresight, Circumspection, Caution. The individual aspects can be emphasized as a coaching point, and helpful defense mechanism against imprudence. The relevant parts of prudence will be defined and explained in each breakdown of the moneys.

The Four Moneys, Fully Deployed

Selfish Money Summary

We use our ambition to benefit ourselves because opportunities are limited. It is often effective short term, with decent gains, and little to no pain up front. Over time, because scarcity and competition remains, it becomes a pyrrhic victory. You stack short term wins, but slowly lose relationships, integrity, and control in an attempt for more, or to preserve what you have. In many cases, long term, the loss of everything. It doesn't always manifest as selfishness, but it is self-focused as the identity becomes defined by measurable metrics.

👓 How the World is Seen

The world has finite opportunity and wealth (scarcity); or everything is a zero-sum game. It is your responsibility to grab your share.

🎧 What We Listen To

“I got this”

“I’ll show you”

“I know what I’m doing”

“Just this once”

“It’s meant to be”

“It’s worked before”

"I am getting mine"

"If I don't, someone else will"

"Winning is everything"

"I'm creating generational wealth"

"What can I get out of this?"

"Business is business"

“I don’t want to be poor”

"I worked too hard, I deserve this"

If the "hustle" micro culture, or modern stoic method works, and you become successful, well done. Keep in mind, since the world is rooted in scarcity, you will never be, or have enough because the desire itself is insatiable. There will be a need to conquer something else, or garner more attention indefinitely.

⏱️ Relationship to Time

Distorts the present (not utilizing all data in front of you leaning on assumptions and success based on the past; or too self-absorbed to anticipate problems.)

🏎️ Drivers

Power; Pride and/or Greed

“It gets dangerous when the taste of having more—more money, more power, more prestige—increases ambition faster than satisfaction...You feel as if you’re falling behind, and the only way to catch up is to take greater and greater amounts of risk.”

🏃Behavior

Inconsideratio is a cause for imprudence. It means being inconsiderate or thoughtless in a decision. It is not lack of IQ. It actually stems from acting “too smart” or more accurately, from the bias of Overconfidence. This is understood as prioritizing immediate gains (money, power, attention) on the basis of your abilities and knowledge while underestimating cumulative risks and/or other people. It is a cerebral decision. Examples are: The Titanic, Blockbuster, and the 2008 crash (The Big Short). On a relational level, people are often evaluated on their usefulness and therefore mostly transactional. Identity is defined based on metrics and titles, therefore behavior is dictated by the narrative that numbers or accolades tell.

“The confidence that individuals have in their beliefs depends mostly on the quality of the story they can tell about what they see, even if they see little. We often fail to allow for the possibility that evidence that should be critical to our judgment is missing—what we see is all there is.”

Clayton Christensen in How Will You Measure Your Life? highlights a similar bias. He uses the idea of marginal cost analysis, a method to determine whether a business decision will increase revenue and lower costs. He uses Blockbuster’s story of ignoring competing against or acquiring Netflix early on because of Blockbuster’s overconfidence in their fat margins from late fees and rentals; whereas Netflix was perceived as a lower margin, niche product. Blockbuster being overconfident in their success, brand, and margins, eventually led to being disrupted, and then bankruptcy. Christensen uses this as a metaphor and warns about the slippery slope of low marginal costs: “the price of doing something wrong just this once usually appears alluringly low. It suckers you in, and you don’t see where that path is ultimately headed or the full cost that the choice entails.” The point is, when we conflate money, success, power with our identity, we either become despondent when we lose some of it, or we sacrifice integrity (our soul) in order to hold onto it...and we never saw it coming because we were inconsiderate of the facts.

🐴 How We Get Persuaded (Pull in the Trojan Horse)

The "vacation" is the salesperson's best ally. This is the vivid image conceptualized in the mind. It is the dream lifestyle, the allure of mass wealth, and the power it promises. It seems good and right, but one subtle angle to cause thoughtlessness and being inconsiderate is the power of suggestion via questioning our ability - "Don’t you want to prove yourself?" "You're a coward" "You don't have what it takes anyways" "Have fun staying poor!" This leads to us ignoring or diminishing red flags to prove our worth. Another tactic is the sunk costs fallacy: "you've some this far, invested so much time, energy, and money so far...can't stop now." Or as mentioned, overconfidence: "look at your success so far." I know what I'm doing, I can handle this, they don't know what they're talking about, or know who I am--I'll show them.

"People’s need for validation and recognition, their need to feel important, is the best kind of weakness to exploit. First, it is almost universal; second, exploiting it is so very easy. All you have to do is find ways to make people feel better about their taste, their social standing, their intelligence.”

🤺 Defense

Circumspection - Because overconfidence is the bias, look around to objectively gather new data points. Having circumspection means you have updated your beliefs with that new data, not just the story you want to tell. It included thinking about who is impacted by your decision, and how.

Docility - The term essentially means you’re coachable; therefore you should have access to seasoned, older mentors who will tell you the truth, and keep you accountable. They usually have seen this movie before. Having wise mentors means nothing if you won't at least consider their advice.

Keep scrolling to Selfish Money or Jump to a different section.

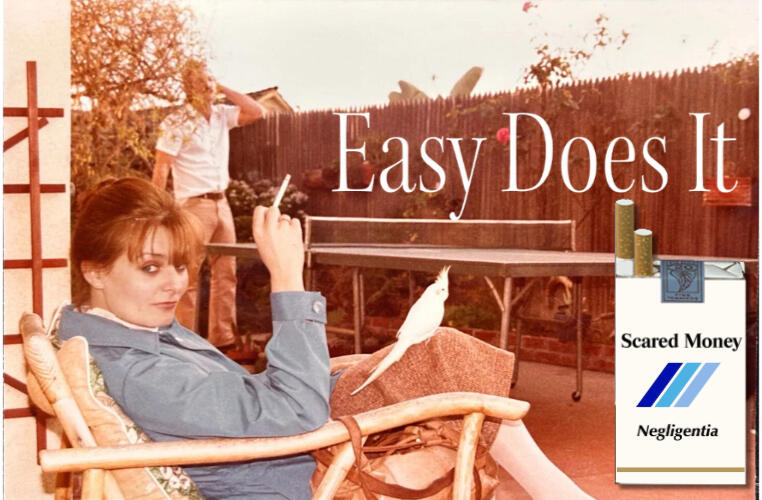

'Scared Money" Summary

Held by the past, we fear failure, or rejection, or pain, or being a disappointment. We refuse to play or invest. Our comfort takes precedence, and it is expected others respect that. If we must play, we play not to lose, or "play it safe." You can't feel failure, if you don't try. This may resemble the perfectionist not willing to take a risk, and finding comfort and identity in being told what to do. There may be a neglect or refusal of opportunities believing they don't carry much expected value, or are worth the time. It is worth noting that oftentimes these end up delivering that highest returns in our lives.

👓 How the World is Seen

The world has finite opportunity and wealth (scarcity). It is your responsibility to protect, or demand your share.

🎧 What We Listen To

“What if I fail?”

“You’re not good enough”

“I always lose anyways, so why try”

“Do what’s comfortable”

"What's the point"

"If its meant to be it'll work out"

"Practice self-care"

"cut your losses"

"you're a fraud, everyone knows"

“quit before it gets worse”

"They are taking advantage of you"

"Leave, no one appreciates you"

Any victory through a "soft living" micro-culture feels empowering, but will never be enough. The world is scarce in resource, so you will instinctively demand more the next time. If and when you hit any resistance, or struggle, your resilience concedes to complaining, and cowardice. Making you feel more sad and demanding more accomodation.

⏱️ Relationship to Time

Enslaved to the Past; either obsessing over the good 'ol days, or allowing an injustice in the past to dictate and color all future actions.

🏎️ Drivers

Self-protection; Fear/Pity; Acedia (which means "lack of care", our feelings of inadequacy suppress our potential for great things). The idolatry of status quo.

🏃Behavior

Negligentia is another reason for imprudence. Translated as negligence, it is not a mistake of action, but rather inaction. It is a willful ignorance, but certainly justified, and/or blinded by the bias of Loss Aversion (fear). It can also be a consequence of Imposter Syndrome (fear that people will find you out you don’t actually have what it takes). Sometimes it is from a poor interpretation of facts, ie: I got a C on a test, therefore I am dumb, so why even try? The fact of getting a C is true, but the interpretation of “I am dumb” is not true. In that moment, a feeling became a standard and dictates your behavior to find comfort. Other scared money expressions may also manifest as conservative action; or playing not to lose. And while being busy and working with your hands can be a defense, to not get too much into your head, it can also be deceptive. Doing too much "busy" yet pointless activity, or planning great things without follow through is as toxic as using self-care as a disguise for avoidance. Consuming lots of self-help content to feel like progress is being made even though no action is taken is another iteration of "busy" activity.

”Loss aversion refers to the relative strength of two motives: we are driven more strongly to avoid losses than to achieve gains. A reference point is sometimes the status quo, but it can also be a goal in the future: not achieving a goal is a loss, exceeding the goal is a gain. As we might expect from negativity dominance, the two motives are not equally powerful. The aversion to the failure of not reaching the goal is much stronger than the desire to exceed it.”

🐴 How We Get Persuaded (Pull in the Trojan Horse)

The quickest way to get hooked is overt fear. There is much profit to be gained from our fears. “Bad things will happen if...” “Do you really want to go through this again?” Passively allowing a narrative of images, or lots of information make us question our true identity and self-worth. Algorithms can also do this. The result is an insecurity, and anxiety created in us. The salesperson knows we aim to find comfort and stability when we feel this way, thus leaving us open for emotional hijacking rooted in flattery, pity, fear, half-truths, and gaslighting. They tell us what we want to hear, making it easier to buy what they are selling. The really deceptive version of the game is not for us to be pitied by someone selling us something, but to set it up in a way where we can give it. Pity allows you to feel better than others without conflict. In short, feeling sorry for ourselves, or others justifies status quo and neglecting personal growth. Whatever the tactic, the goal is to get you to reject or bury or be negligent of your potential, so someone else can profit off you, your time, your energy.

🤺 Defense

Understanding - This asks, what is really at stake, is my perspective incorrect? Is this just irrational fear? In other words, since feelings are overvalued here, it is giving the proper weight to those feelings and our objective values.

Reason - Once you understand now make your feelings subservient to reason and values. Once you figure out the game actually worth playing, blueprint it out: how can I practically start playing?

Foresight - With fear being defanged, concerns properly framed, and a game worth playing, how might this decision turn out for serendipity? What is the likely risk/reward, and remorse/regret)? Consider a more optimistic outlook.

“...persons need not only other people but also...games worth playing. [People] suffer grievously when they find no games worth playing, even though their object world might remain quite intact.”

Keep scrolling to Stupid Money or Jump to a different section.

"Stupid Money" Summary

We make impulsive decisions to indulge and maximize our pleasure and happiness. We justify it mainly through our feelings and desires. Oftentimes, the justification is not even rational, it is just a strong impulse driven by dopamine or hormones. The reward is short-lived, and often carries regret & diminishing returns. Nothing meaningful can compound in this state as investment of time and money gets spreads out too thin. There is a tendency to put things off, rack debt, and deal with it down the road later.

👓 How the World is Seen

There is assumed surplus; or opportunity to figure it out later will be there

🎧 What We Listen To

“Now or never”

“I deserve this”

“Everyone one else is”

“It’ll make you happy”

"It's only money"

"Go into debt if you have to"

"Why save for an uncertain future?"

"Do it for the plot, create some lore

"I lost, I gotta make up for this"

"it's my fault, I gotta make up for this."

"You only live once"

"I don't want to miss out"

Any victory in this culture either through speculative investments, or gambling yields enormous dopamine and jubilation, but because there is no inherent meaning, you get stuck on the addictive hedonic treadmill perpetually chasing wins & losses.

⏱️ Relationship to Time

Sabotaging the Future (buy now, pay later); for some, there isn't a future to believe in.

🏎️ Drivers

Feeling a right to, or entitled to things; Envy and/or Lust; And/or Anger. Anger not just at people, but circumstances/situations.

🏃Behavior

Precipitatio is another cause for imprudence. A helpful translation is impulsivity. It plays out as a Fixed-Cost Present Bias (meaning a preference for immediate rewards as opposed to delayed gratification). This can be justified through entitlement, conformity and/or mimetic desire. The “I want it now” mentality facilitates addiction. Emotions take over, justifying "chasing losses" and/or "gamer's tilt" (where after a loss, you lose control and make irrational decisions). Stupid Money can look like poor spending habits, "78% of professional athletes go broke after just three years of retirement” (Craig Brown, NKSFB Sports Business Division). Anger and disillusionment of unfair systems and institutions is the cultural response. For example, "financial nihilism" is the denial that traditional hard work, saving, and investing will lead to financial stability, and so the only real option is making high risk, high reward, absurd speculative bets like highly leveraged memecoins, or 15 leg parlays.

"Above all, don't lie to yourself. The man who lies to himself and listens to his own lie comes to such a pass that he cannot distinguish the truth within him, or around him, and so loses all respect for himself and for others. And having no respect he ceases to love, and in order to occupy and distract himself without love he gives way to passions and coarse pleasures, and sinks to bestiality in his vices, all from continual lying to other men and to himself. "

🐴 How We Get Persuaded (Pull in the Trojan Horse)

The tactic is to get us to over-index on emotions, and desire to drive us to get the benefits or “vacation.” Once the desire is strong there is an openness to over-spiritualizing (or confirmation bias). In other words, any half truths people tell you; or unrelated events you experience or seen as a "green light" or sign from the universe and/or permission. Other sinister desire drivers are social proof, and “rags to riches” and “get rich quick” narratives (if it worked for them). These narratives include vivid benefits, material things, and luxury travel. The close is often emotionally-driven high pressure sales (urgency), or speaking to entitlement (you deserve happiness more than they do). People operating from Selfish Money will do what they can to get you to be in a state of Stupid Money. They get you to make an impulsive decision in their favor, and then make it impossible to get your investment back. Impulsivity can also occur through fatigue, either through excessive content (brainwashing), or classic dopamine dependency. Finally, rage baiting is an easy way to drag you into impulsivity, and into a poisonous cycle of “doom scrolling” leaving you open to emotional hijacking.

🤺 Defense

Shrewdness - This is a skillful self-awareness: not just knowing your tendencies/weaknesses, but very in tune with spotting the sales tactics, and manipulation.

Memory - This is taking a moment and learning from, and applying the past experiences and stories of impulsive destruction from yourself or others.

Caution - Impulsiveness lacks friction, so leading from boundaries and constraints you've already set instead from desires is a helpful defense strategy.

“The hardest financial skill is getting the goalpost to stop moving.”

"House Money" Summary

The "house money effect" describes a bias where people are more willing to take risks with money they've won, or gained. It can lead to imprudence and carelessness. However, if you are prudent and shrewd, it changes the game and system. Like the House Money effect, living with House Money means feeling free to take more calculated risks, initiate people, be generous with resources, and inviting others to share in things. It is free from expectation of reciprocity, entitlement, and anxiety, because you are laying with house money (surplus). It is not a mindset you conjure up, but like real house money, it is drawn from real assets: your identity, imagination, giftedness and resources. Even athletic contexts use the term "house money" to describe a sense of freedom, aggressiveness, and fun, because expectations were shattered. It's almost like you've already won, and can play that way.

👓 How the World is Seen

There is assumed surplus. In a world which emphasizes our lack, or not being or having enough, house money doubles down on all the assets we already have.

🎧 What We Listen To

“If it doesn't work, I'm playing with house money”

“If they don't appreciate my generosity, it's fine”

“I am free to do this"

"I get to do this”

“How can I best solve this problem?”

“I have plenty of gifts to use”

"I am made for this"

"scared money don't make no money"

Success from house money, or even failure, does not define you. Loss and failure, while not ideal, are seen to still carry benefits. This thinking allows for operating out of surplus, a healthy identity, and optimism

⏱️ Relationship to Time

Emphasis on Meaning in Time (you index more on moments, not the time we measure, or spend); Uses Bayesian Inference/Updating (taking stock of the latest data in conjunction with the past, present, and future in view in order to properly update beliefs.

🏎️ Drivers

Gratitude, honor and privilege. Purpose and Mission is in harmony with Generosity and Joy

🏃Behavior

The thinking here is that behind our wants is a desire for a certain state of being. Behind the desire for a sports car, or someone else's life is not the thing, but what is promises to make us feel. The premise of House Money is to adapt the game. It isn't about endlessly chasing things to get that feeling, but to recognize it is available now. That state of being? Gratitude, joy, fearlessness, playing to win, confidence, taking calculated risks, being more generous, initiating hospitality, having less expectation and entitlement. This is what we see and want when we see successful and "happy" people. This is what people try to sell us.In that state, any generosity given is more unconditional in nature, any ROI is viewed as a gift, not an expectation. It just means more house money to play with. If a kind act or gesture is not reciprocated, it is not a cause of pettiness. There is plenty. It doesn't mean don't have backbone or boundaries, it just means expectations are sidelined.In practice, house money is being shrewd. Being shrewd often carries a negative connotation, but it is purely in how you use it. Just like money can be used for good or bad, shrewdness can also be implemented for selfish, or altruistic purposes. The supporting phrase, "wise as serpents" simply creates a reflection on how snakes are incredibly calculating. They are a living SWOT analysis. They know their strengths, their weaknesses, when to strike on opportunities, and manage threats. You have solid sense of self-awareness, a good handle on people, and human nature.Therefore, living with House Money means you establish a "hedge fund" against imprudence, by assembling a team who wants to play the same game worth playing: creating new forms of wealth, solving real problems, and extending prosperity to others by leveraging your existing resources, identity, skills, and imagination. This is where self-worth and net worth can 100x.

"It is character, not numbers, that make the world go ‘round. How can we possibly measure the qualities of human existence that give our lives and careers meaning? How about grace, kindness, and integrity? What value do we put on passion, devotion, and trust? How much do cheerfulness, the lilt of a human voice, and a touch of pride add to our lives? Tell me, please, if you can, how to value friendship, cooperation, dedication, and spirit. Categorically, the firm that ignores the intangible qualities that the human beings who are our colleagues bring to their careers will never build a great workforce or a great organization.”

🚨 How to Persuade

The dynamic changes since we aren't being baited to drag something in, because house money operates not from lack, but from surplus. The game is figuring out how to be more hospitable with those resources. Parker Palmer puts it this way: "The human soul doesn’t want to be advised or fixed or saved. It simply wants to be witnessed — to be seen, heard and companioned exactly as it is." Shrewdness understands this and can leverage it to gently persuade others to be a part of something bigger than themselves, a game worth playing, something that benefits others, not just them.

🤺 Defense

When all 8 parts of prudence are exercised, something happens: “Magnanimity” (magna-nim-ity). It is just a fancy word, which means greatness of soul. This is essentially your character. Again, Aquinas suggests we can enlarge our soul, or shrink it. Greatness, then, is great people (souls) doing courageous things. Modern examples of practicing this are projects like: yes theory or rejection therapy. Think of Magnanimity as resistance or strength training for your character.Conversely, shrinkage or atrophy of soul is as Aquinas writes, “ignorance of one’s qualifications and on the part of the appetite the fear of failure in what one falsely deems to exceed one’s ability.” Magnanimity then, is growing your character through action. The more you act courageously & live with House Money, the bigger, stronger, greater, wealthier (not money) you get. Note again that "Scared Money" is the antithesis. While Scared and Stupid pull away from living House Money, the shrinking of self in Scared Money is the anti-House Money.

“Our levels of desire, patience, persistence, and confidence end up playing a much larger role in success than sheer reasoning powers. Feeling motivated and energized, we can overcome almost anything. Feeling bored and restless, our minds shut”

Note: House Money cannot exist without real assets. You cannot fake it, or pretend like you have it. It doesn't work--you will play scared. House Money is a "team sport." It is healthiest when implemented within a group. You have to gather with friends who will tell the truth to each other, and encourage how to use your material and non-material assets.

Let's Be Shrewd Together

Copyright © 2025 fourmoneys.com. All rights reserved.

Notes

1. McLuhan wrote how technology is an extension of ourselves. In order to sustain our expanding self, we must "self-amputate" something. Ellul explained that technique (the philosophy behind technology) is judged on efficiency, and is amoral. In other words, we can conveniently order food in a pinch; but the same technology delivers vices, or sustain addictions, in the same manner. Technology doesn't have a filter, just efficiency. Avner Offer, observed the speed at which novelty and rewards come at us today, is faster than our ability to "prudently" discern what is good and bad for us. We then lose the filter altogether, because we never train it. Neil Postman argued similar concerns in Amusing Ourselves to Death, where everything becomes entertainment, thereby losing critical thinking. And Gen Z blogger, Kyla Scanlon has observed this as well, calling it the "convenience contradiction." Pick your thinker or angle: but they are all pointing to the same thing: the increase in the benefits and pleasures of technology come at a cost to our well-being.